Настройки шрифта

Размер шрифта

Межбуквенное расстояние

Цветовая схема

For the purposes of providing insurance cover for commercial banks executing bank guarantees and letters of credit, Eximgarant of Belarus offers a special insurance product — the insurance of bank guarantees or other services provided by the exporter’s bank to overseas buyers.

The insurance covers losses resulting from the following:

- groundless request of the beneficiary that the guaranteed payment be effected — unless the principal (domestic exporter) violates in any way his obligations under the export contract secured by a bank guarantee, and in case of exposure to political risks of any kind;

- grounded request of the beneficiary that the guaranteed payment be effected — in case the principal violates the terms and conditions of the export contract.

The insurance of bank guarantees not only ensures the conclusion of an export contract and full implementation thereof, but also prevents the exporter’s bank from suffering any losses when executing a bank guarantee.

This insurance product also allows to cover any losses suffered by the confirming bank due to the execution of a letter of credit drawn by the overseas buyer’s bank in favour of the domestic exporter.

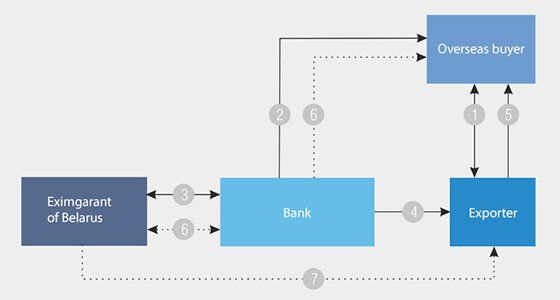

The procedure of interaction:

- export contract, previously agreed upon with Eximgarant of Belarus;

- guarantee of the domestic bank for the exporter’s obligations;

- insurance contract;

- verification of the exporter’s behaviour by the bank;

- fulfillment of obligations by the exporter.

- execution of the guarantee, payment of the insurance compensation, transfer of the right of claim to Eximgarant of Belarus;

- raising claims against the exporter.

The list of documents required for the conclusion of an insurance contract:

- application for the conclusion of an insurance contract;

- when a bank guarantee is insured:

- constituent documents, certificate of registry — provided that it is the first insurance contract concluded with this insurant;

- the principal’s state registration documents;

- contract for the issuance of a guarantee with all the relevant documents attached, including the following:

- particulars of the deal stipulating that the fulfillment of obligations be secured;

- treaty (contract) providing that the principal should issue a guarantee as a security for his obligations under the contract;

- the principal’s financial statements: annual balance sheet with all supplements thereto, balance sheet as of the last reporting date, statement of profit and loss, obligatory audit report, etc.;

- documents securing the guaranteed fulfillment of obligations for the insurant by the principal: pledge agreements and guarantees;

- bank guarantee or the draft bank guarantee issued;

- statement of the account for guarantees issued by the bank;

- when a confirmed letter of credit is insured:

- constituent documents, certificate of registry — provided that it is the first insurance contract concluded with this insurant;

- application for a letter of credit;

- record of the letter of credit;

- the insurer has the right to request from the insurant other documents essential for the evaluation of the degree of risk and making a decision on the conclusion of an insurance contract;

- the insurant is responsible for the authenticity of the documents submitted and for the reliability of the information communicated to the insurer;

- when an insurance contract is concluded, the insurer has the right to request additional information from those who may be able to provide it.

наверх