Eximgarant of Belarus provides an insurance product aimed at economic protection of the lessor carrying out export operations — insurance against export risks of residents of the Republic of Belarus purchasing the goods from other residents of the Republic of Belarus for leasing them to non-resident organizations in the Republic of Belarus including banks.

The insurance covers losses incurred by the lessor (resident of the Republic of Belarus) in case the lessee fails to carry out his obligations to effect lease payments under the circumstances of political or commercial risk.

We are willing to cooperate with all the Belarusian leasing companies, and we offer an up-to-date, reliable and flexible insurance product which will serve as a trustworthy instrument to do business in external markets. We assist the lessor in conducting negotiations, signing contracts, evaluating the lessee’s solvency and in arranging the financing of a deal. Eximgarant of Belarus offers flexible insurance rates and convenient modes of payment of insurance premiums.

Cooperation with Eximgarant of Belarus not only allows the lessor to receive lease payments in due course and to secure timely cash receipts, but also gives him an opportunity to gather complete and reliable information on his contractor.

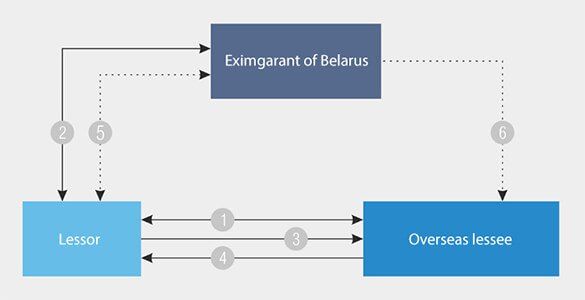

The procedure of interaction:

- leasing contract (before it is concluded — the draft leasing contract, agreed upon with Eximgarant of Belarus);

- insurance contract;

- shipment of the object of leasing;

- lease payments by the overseas lessee to the lessor.

- payment of the insurance compensation, transfer of the right of claim to Eximgarant of Belarus;

- raising claims against the overseas lessee.

The list of documents required for the conclusion of an insurance contract:

- application for the conclusion of an insurance contract;

- the Charter, the registration document of the insurant (in case it is the first insurance contract concluded with this insurant);

- authorizations, licenses, certificates and patents for the relevant activities;

- documents showing the insurant’s property status (balance sheet of the enterprise as of the last reporting date, etc.);

- the document authorizing the responsible official to conclude an insurance contract on behalf of the insurant;

- leasing contract (or the draft leasing contract), delivery notes and other documents relevant to the deal;

- information on the execution of similar contracts concluded with this lessee before;

- information on the guarantees of the fulfillment of obligations, if any;

- other documents upon the insurer’s request essential for the evaluation of the degree of risk.

The insurant should provide the insurer with the information on the lessee’s property status, if any (the lessee’s balance sheet as of the last reporting date, profit and loss statement, information on any outstanding credit liabilities including interest (the amount due and the term of payment), statement of accounts receivable and accounts payable as of the date the application for insurance was filed, with the date when the liabilities appeared and the term of repayment, as well as the available sources of funds for payments under the leasing contract, etc.).

When an insurance contract is concluded, the insurer has the right to request the information on the lessee from those who may be able to provide it.

Insurance regulations No. 41.